46% of reinsurance market and 37% of industry’s global assets covered by coal exit policies. The number of insurers withdrawing cover for coal has more than doubled in 2019 as the industry’s retreat from the sector accelerates and spreads beyond Europe, the Unfriend Coal campaign reveals today in its third annual scorecard on insurance, coal and climate change.

Insuring Coal No More: The 2019 Scorecard on Insurance, Coal and Climate Change is published by 13 civil society organisations from 10 countries. It will be launched to an industry audience at the Insurance and Climate Risk conference in London, as the UN Climate Summit commences in Madrid.

Coal exit policies have been announced by 17 of the world’s biggest insurers controlling 46.4% of the reinsurance market and 9.5% of the primary insurance market. Most refuse to insure new mines and power plants, while industry leaders have ended cover for existing coal projects and the companies that operate them, and adopted similar policies for tar sands.

Insurers have also divested coal from roughly $8.9 trillion of investments – over one-third (37%) of the industry’s global assets. To date, at least 35 companies have taken action, up from 15 companies with $4 trillion assets under management in 2017 and 19 with $6 trillion in 2018.

Nearly 1,000 planned new coal plants will undermine international climate targets

The UN’s Intergovernmental Panel on Climate Change has warned that warming beyond 1.5°C will have devastating environmental, social and economic impacts. Yet in July 2019, 2,459 coal plants with a combined capacity of 2,027 gigawatts were in operation, and another 980 with a combined capacity of 925 gigawatts were planned or under construction.

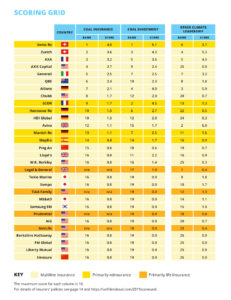

The scorecard ranks 30 leading insurers on their action on coal and climate change, assessing and scoring their polices on underwriting, divestment and other aspects of climate leadership. It is based on responses to a survey from 24 of these companies and on publicly available information.

Coal projects suffer as insurance market shrinks

Insurer action on coal is causing tangible impact; insurance brokers report that the cost of insuring coal is increasing as the market shrinks. In September 2019, UK broker Willis Towers Watson described an “increasing and worrying trend for insurers to withdraw from what they consider to be environmentally unfriendly industries such as coal”, warning that this trend “leaves very few primary markets for coal miners to turn to”.

Several coal companies have confirmed that a shrinking insurance market is affecting their operations. In Australia, the Adani Group is struggling to find insurance to develop the huge Carmichael mine, which would produce 4.6 billion tonnes of carbon dioxide over its lifetime. At least 16 international insurers have ruled out underwriting the project.

The full scoring information for the 30 insurance companies is available here.