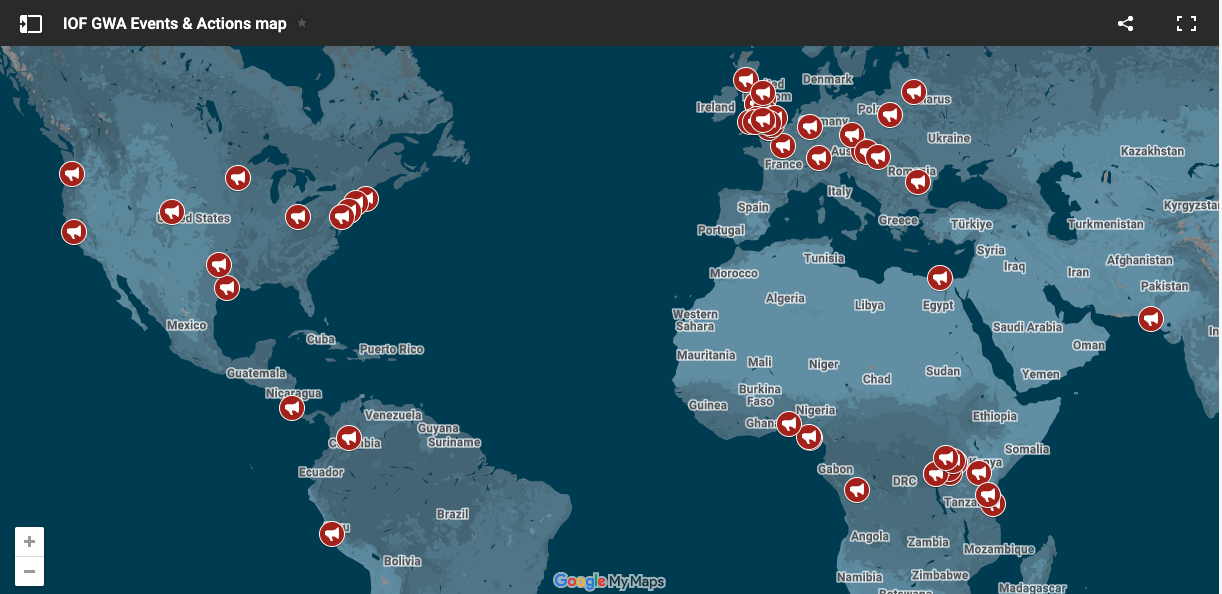

The Insure Our Future network and communities from across the world are coming together for the first ever Global Week of Action to spotlight and target the insurance industry for their role in the climate crisis and demand action. Groups in over 27 countries across 5 continents are holding a week’s worth of demonstrations, marches, direct actions, creative and community events with a clear message: Insure Our Future, not fossil fuels.

Why target the insurance industry?

Fossil fuel projects need three things to operate: permits, money and insurance. Insurance can be the Achilles heel of the fossil fuel industry: Without insurance, coal mines, LNG facilities or oil pipelines can’t go ahead.

Insurers are the risk managers of society. Their job is to measure risk and protect people from it, to essentially be a safety net for when things go wrong. But the insurance industry is setting fire to our collective safety net by insuring and investing in new and expanded fossil fuel projects.

Insurers are experts in greenwashing: they like to talk a good game on ‘sustainability’ and ‘looking after the future’, but their actions tell a different story. In the USA and Australia, insurers are turning their backs on vulnerable communities by pulling home insurance from those areas most at risk of wildfires, flooding and storms.

Insuring and investing in fossil fuels is not even in their best business interests. Insurers are losing huge amounts of money to natural catastrophes (e.g. storm, wildfire, and flood damage). While insuring fossil fuels earned the industry approximately $21.25 billion in 2022, extreme weather caused an estimated $270 billion in damages, of which approximately $120 billion were insured. Natural catastrophes have cost the industry an average of $110 billion a year since 2017.

Insurers are passing the cost of the climate crisis to communities

In response to these huge losses, many insurers are raising their home insurance prices to try and claw back some money. Insurers are effectively passing on the cost of their dirty business to ordinary consumers. This comes at a time when many families are struggling to stay afloat, facing rising prices and a global cost-of-living crisis.

What impact can we have?

The fossil fuel insurance industry is very concentrated. Just 20 companies provide around 70% of the insurance for the world’s fossil fuel industry. Just 6 reinsurance companies control an estimated 50% of the global reinsurance market. Therefore, when we move a few key players we can have a huge impact.

Insurance campaigning has already made new coal plants almost uninsurable and stopped many from going ahead. Due to the Insure Our Future campaign, 45 companies have committed to end or restrict insurance for coal projects, and 26 companies have introduced policies committing to end or restrict insurance on tar sands projects.

Now, we need to do the same for oil and gas.

What are we fighting for?

Insurance companies have a huge amount of power to change the course of history at this vital time, but they often sail under the public radar, which is why this Global Week of Action is so important. Some of the most progressive insurance industry actors have started to move away from fossil fuels. But many climate laggards need to be pressured to shift and implement ambitious climate action.

Our demands to the insurance industry:

- Stop enabling fossil fuels

- Respect human rights

- Support a just transition

Join us!

If enough of us push the insurance industry to change – putting people over profit, protecting communities, and insuring clean, green energy instead of dirty fossil fuels – then we can truly create a powerful impact and help ensure a safer tomorrow for our communities.

Digital actions are organised by a variety of groups. We encourage you to take part in these actions yourself to demand insurance companies stop insuring fossil fuel criminals and share them far and wide using this link: https://bit.ly/GWADigiActions!

Thank you for joining the fight for our collective future! Together, we can win.