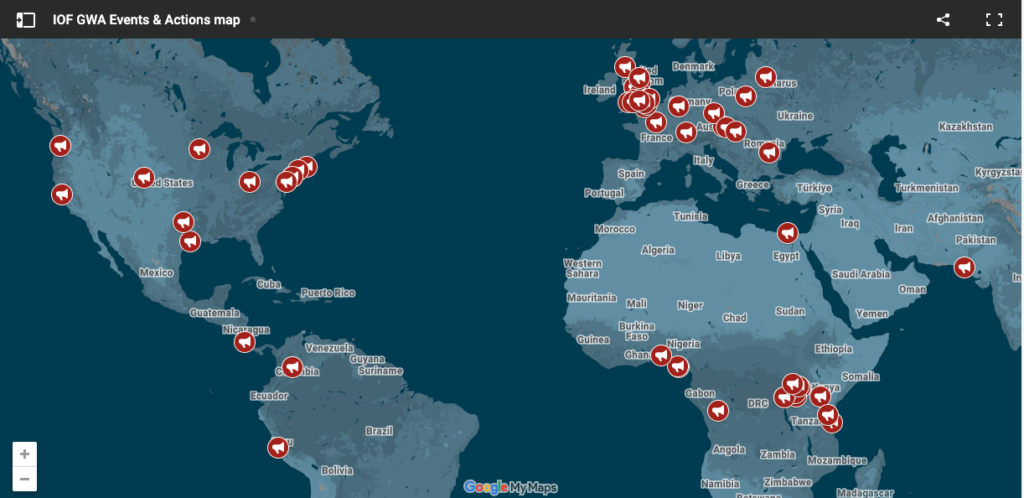

In the last week of February, people in over 30 countries across the world organized demonstrations, marches, and community events at some of the largest global insurance companies – including AIG, Tokio Marine, Zurich, Chubb, Lloyd’s of London, Travelers, Sompo, and The Hartford. These events brought a clear message: Insure our future, not fossil fuels. You may have seen coverage of these events in The Guardian, The Telegraph, The Canary, Texas Public Radio, Insurance Business, Univision (en español) and other news outlets.

If you work at one of these companies, reading about these events (or seeing them from your office window) might be puzzling to you, it could be uncomfortable, or, recognizing the role that insurance could play in addressing climate change, it could be inspiring.

Swipe through the album to see photos from around the world.

Despite talking about the need to address the climate protection gap, insurers are withdrawing coverage for homes and businesses that are heavily exposed to natural disasters made worse by climate change. I have a front row seat to the insurance fallout from wildfires here in California, where several property and casualty carriers have announced they will no longer cover homes and businesses in the state and my neighbors are left scrambling for meager coverage at 2-3 times their previous rates.

But what many people, including some of the employees of these very companies, do not know is that these same carriers are adding fuel to the fire.

How? They continue to underwrite the fossil fuel sector. This includes new infrastructure – including oil and gas pipelines, LNG export terminals, offshore oil development – that is totally at odds with climate scientists’ recommendations to avoid a tipping point for runaway global warming and is unnecessary to address energy security needs in Europe and Asia.

Our latest report with @Public_Citizen and @Insure_Future exposes the 35+ insurance companies that are backing methane gas expansion in the Gulf South (like @Chubb & @AIGinsurance) and unveils certificates from 7 projects across the US.

Learn more: https://t.co/R6IP5HGpyG pic.twitter.com/npmgNmc7XE

— Rainforest Action Network (RAN) 🌴 (@RAN) February 25, 2024

In fact, the insurance industry has done this with coal plants, to some extent. Insurers’ shift away from coal over the last few years, making new coal power plants outside of China all but uninsurable (and therefore not viable), shows the real world implications. It’s an example of the impact insurers can have when their business decisions consider more than just the next quarter’s returns.

Insurers now need to help accelerate the global transition away from oil and gas toward clean renewable energy.

People around the world took to the streets to call on insurers to stop enabling the expansion of fossil fuels that are causing climate change. How will your company answer?

💥 University of Sheffield students disrupt work experience fair calling for fossil free careers!

👏👏👏 Shout out to @PandPSheffield for this action and calling out the presence of an engineering consultancy firm that works with fossil fuel and mining companies! pic.twitter.com/sVmEyBcwer

— People & Planet (@peopleandplanet) February 27, 2024