Below, the letter “Request to engage with SOMPO to stop underwriting new fossil fuel projects” was submitted to SOMPO’s 50 large shareholders.

August 28, 2024

Dear Shareholders of SOMPO Holdings,

Request to engage with SOMPO to stop underwriting new fossil fuel projects

Japan Center for a Sustainable Environment and Society (JACSES)

Friends of the Earth Japan

Mekong Watch

Rainforest Action Network

Insure Our Future

We, as environmental NGOs, have been urging financial institutions to be consistent with the goal of limiting warming to 1.5 degrees set by the Paris Agreement and stop providing support for fossil fuel projects. This is absolutely necessary to achieve the 1.5 degrees goal of the Paris Agreement in order to avoid the worst-case scenario of climate change. There must be an immediate end to the insuring of any customers from the fossil fuel sector which have not published a transition plan aligned with a credible 1.5°C pathway. In addition that banks halting financial support for fossil fuel projects, we recognize that non-life insurance companies that enable financing for fossil fuel projects play a vital role in the energy transition by announcing an end to underwriting for fossil fuel projects. This time, we are sending this request letter to 50 financial institutions who are the major shareholders of SOMPO Holdings (hereinafter referred to as SOMPO), including your institution, asking for engagement with SOMPO to withdraw from underwriting fossil fuel projects.

1. SOMPO’s underwriting policy is not aligned with the 1.5-degrees goal.

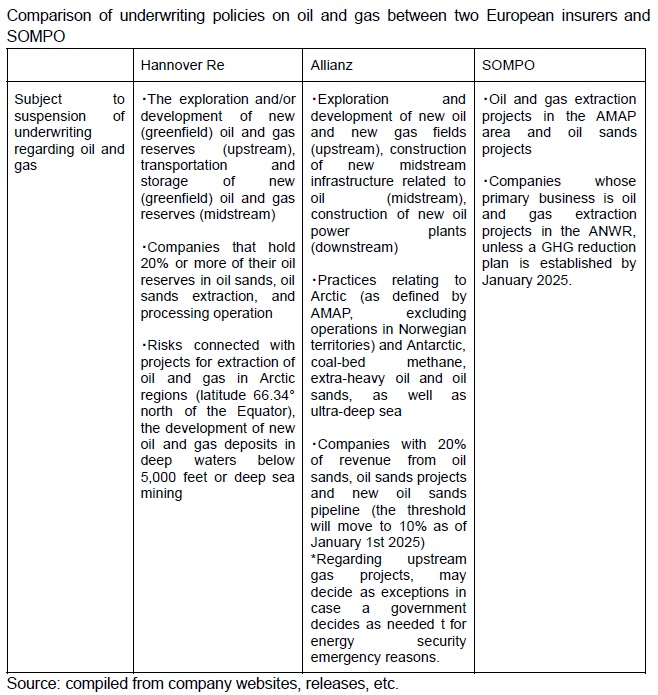

A growing number of insurers have expanded restrictions on underwriting to cover not only coal-related projects but also oil and gas projects. To date, 18 global insurers have enacted policies restricting new insurance underwriting for oil and gas projects. Major European insurers, such as Hannover Re and Allianz, have taken steps to stop underwriting conventional oil and gas projects. In contrast, the scope of oil and gas restriction of SOMPO is limited to oil sands and the projects in Arctic Monitoring and Assessment Programme (AMAP) areas.

According to the report “Net Zero by 2050, A Roadmap for Global Energy Sector” released by the International Energy Agency (IEA) in 2021, no new fossil fuel extraction projects should be approved if we are to achieve net zero by 2050 (*1). SOMPO’s underwriting policy, however, still allows for underwriting and investing in new fossil fuel projects, demonstrating a lack of alignment with the 1.5 degrees goal of the Paris Agreement.

2. SOMPO has not withdrawn from new fossil fuel projects such as Rio Grande LNG in the USA, which SMBC, Société Générale, Credit Suisse, and Chubb have withdrawn.

SOMPO is known to have underwritten insurance for the Rio Grande LNG project, a liquefied natural gas (LNG) export terminal project in Texas, USA, led by NextDecade (*2). It has not ruled out underwriting its renewal, leaving room for ongoing involvement. Moreover, it is reported that the life-cycle CO2 emissions of Rio Grande LNG is 163 million tons, comparable to 44 coal-fired power plants (*3). As Rio Grande LNG will be fed with gas from Eagle Ford and Permian Shale Basin, the projected production from the Permian Basin alone could use up 10% of the global carbon budget (*4). NextDecade, the operator of the Rio Grande LNG project, initially claimed that the use of carbon capture and storage (CCS) technology will reduce CO2 emissions during the gas cooling process by 90%, however, in August this year it scraped its plan for the CCS project. Although the Federal Energy Regulatory Commission (FERC) approved the permit to build and operate the Rio Grande LNG in April 2023, NextDecade has not responded to FERC’s request for information on the CCS project for over a year, and in August the FERC’s approval was quashed by a local court for failing to adequately assess the climate impacts of the Rio Grande LNG (*5). SMBC, one of the Japanese megabanks, has announced its withdrawal from the Rio Grande LNG project, along with Société Générale and Credit Suisse. It has been revealed that Chubb, a major Swiss insurance company, did not underwrite further insurance as of March 2024, when insurance contracts were due for renewal.

SOMPO also underwrote the Ichthys LNG project (Phase 1) between 2012 and 2017, the project with the highest carbon emission factor in Australia, leaving scope to underwrite the currently planned expansion project called ‘2C (*6)’. It also is revealed that SOMPO underwrote Vår Energi, which has been operating several oil and gas projects in the Norwegian Sea region (*7), and could continue underwriting energy extraction projects in this region, where oil and gas projects have been actively carried out. There is also a possibility that SOMPO will underwrite the Papua LNG project, a new gas project in Papua New Guinea (*8). that has not obtained Free, Prior, and Informed Consent (FPIC) from Indigenous peoples and poses significant risks to biodiversity caused by the deforestation of primary forests.

3. SOMPO does not have a policy to respect the rights of indigenous peoples, including FPIC.

SOMPO does not have a policy on Free, Prior and Informed Consent (FPIC), which is required in the United Nations Declaration on the Rights of Indigenous Peoples. On the other hand, Axis Capital has set a policy stipulating that it will not underwrite new projects without FPIC of impacted indigenous communities in accordance with the United Nations Declaration on the Rights of Indigenous Peoples (*9).

NextDecade, the operator of the Rio Grande LNG project which SOMPO is underwriting, has never held a consultation meeting with indigenous peoples regarding the Rio Grande LNG project and FPIC has never been obtained. The construction site of the project is adjacent to the Gracia Pasture, which is listed on the National Register of Historic Places as well as a sanctuary of the indigenous Carrizo/Comecrudo tribe. There may be Indigenous cemeteries/artifacts in the ground. Indigenous peoples and local civil society groups insisted on the necessity to conduct data collection of cultural heritage and cultural archaeological surveys, however, no surveys were carried out and heavy machinery cleared land in October 2023. So far, local residents, environmental NGOs, and local authorities have protested and filed lawsuits, claiming that the operator has failed to conduct proper environmental impact studies. The residents won their case in August this year when the local court quashed the approval for the construction and operation of the project. (*10)

On June 18, 28 domestic and overseas environmental NGOs jointly sent a request letter to Mikio Okumura, CEO of SOMPO, urging him to stop underwriting the Rio Grande LNG project (*11). At SOMPO’s annual general meeting, when Yuki Tanabe, a Program Director of Japan Center for a Sustainable Environment and Society (JACSES), asked about the possibility of further insurance contract renewal of the Rio Grande LNG project, SOMPO’s management responded that they would refrain from answering on individual projects. Outside the venue, an action was taken by environmental NGOs to demand SOMPO to stop underwriting new fossil fuel projects, including the Rio Grande LNG project.

We are requesting you, as a SOMPO’s major shareholder, to engage with SOMPO to urge it to stop underwriting the Rio Grande LNG project and adopt a policy to stop underwriting new fossil fuel projects, in order to align its underwriting policy with the goals of the Paris Agreement.

Also as to this request, we would appreciate an opportunity for dialogue (e.g. online meeting) to hear your institution’s policy and opinion. May we request you to let us know any convenient dates by September 28, for that opportunity? In case it is difficult to have a meeting with us, we would still be grateful to receive information about how you responded to our request in writing.

Thank you for your consideration and we look forward to receiving your response.

Notes:

*1: International Energy Agency (IEA), (2021), 「Net Zero by 2050, A Roadmap for the Global Energy Sector」, p. 20,

https://iea.blob.core.windows.net/assets/0716bb9a-6138-4918-8023-cb24caa47794/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf

*2: For an overview of the Rio Grande LNG project and the issues involved, see the factsheet below.

https://drive.google.com/file/d/1mLgfL-VQHtyn2w2N7e92sDtZaSqQ_N3V/view?usp=sharing

*3: https://www.theguardian.com/environment/2023/feb/03/carbon-capture-gas-exports-rio-grande-lng-nextdecade#:~:text=And%20that%20impact%20could%20be,or%20more%20than%2035m%20cars

*4:

https://www.sierraclub.org/sites/www.sierraclub.org/files/2022-10/RGV_LNG_2022_FINAL_WEB_0.pdf

*5: https://www.utilitydive.com/news/dc-circuit-appeals-ferc-lng-gas-nextdecade-glenfarne-rio-grande-sierra-club/723544/

*6: https://reclaimfinance.org/site/en/2022/10/05/will-major-insurers-rule-out-support-for-ichthys-lngs-expansion/

*7: https://www.greenpeace.org/static/planet4-norway-stateless/2023/05/29fbf8d4-ensuring-disaster-final-20220523-13-41.pdf

*8: For more information on issues related to the Papua LNG project, see the following report. https://fairfinance.jp/bank/casestudies/papua_lng2024/

*9: https://www.ran.org/press-releases/axis-capital-becomes-first-north-american-insurer-to-adopt-policy-on-free-prior-and-informed-consent/

*10: https://www.sierraclub.org/press-releases/2024/08/dc-circuit-rules-against-ferc-approval-lng-and-pipeline-projects-south-texas

*11: https://jacses.org/wp_jp/wp-content/uploads/2019/10/RGV_-Sompo-Letter-June-2024.pdf

List of financial institutions that received this letter

1. BlackRock Inc

2. JP Morgan Asset Management

3. Nomura Asset Management

4. Sumitomo Mitsui Trust Asset Management

5. Nikko Asset Management

6. Norges Bank

7. Mitsubishi UFJ Asset Management

8. Vanguard Group Inc

9. First Eagle Investment Management

10. State Street Corp

11. Goldman Sachs Asset Management

12. Sumitomo Mitsui DS Asset Management Company

13. Crédit Agricole

14. FMR LLC

15. FIL Ltd

16. Orbis Allan Gray Ltd

17. T Rowe Price Group Inc

18. Teachers Insurance & Annuity Association

19. UBS Asset Management (UK) Ltd.

20. Deutsche Bank AG

21. Charles Schwab Investment Management, Inc.

22. BNP Paribas SA

23. Asset Management One

24. SPARX Asset Management Co., Ltd.

25. Nordea Bank Abp

26. WisdomTree Inc

27. Dimensional Fund Advisors LP

28. Pictet Asset Management Ltd

29. Geode Capital Management LLC

30. Royal Bank of Canada

31. Principal Assset Management

32. Prudential Financial Inc

33. Credit Suisse Asset Management

34. Sparinvest Fondsmaeglerselskab A/S

35. LPP (Local Pensions Partnership) LPP I ASSET POOLING AUTHOR

36. Capita PLC

37. Artemis Investment Management LLP

38. Toronto-Dominion Bank/The

39. Zuercher Kantonalbank

40. MITONOPTIMAL UK LIMITED

41. Marsh & McLennan Cos Inc

42. HSBC Asset management

43. Royal London Asset Management Ltd

44. Hennessy Advisors Inc

45. Canadian Imperial Bank of Commerce

46. Norinchukin Zenkyoren Asset Management

47. DekaBank Deutsche Girozentrale

48. Resona Asset Management Co Ltd

49. Meiji Yasuda Life Insurance Co

50. Irish Life Investment Managers Ltd