Many of the world’s biggest insurers, including AIG, Munich Re and Zurich, are undermining global climate goals and Indigenous rights by supporting the tar sands industry, reveals a briefing paper by Insure Our Future Heads in the sand? The insurance industry, tar sands and pipelines.

NGOs supporting the campaign have also written a letter to CEOs of the world’s largest insurance companies, meeting in Paris this week, calling on the industry to divest from coal, tar sands and associated pipeline projects and cease providing insurance cover to these climate-destroying fossil fuel projects.

"New tar sands and pipeline projects lock in high carbon emissions for decades to come and are incompatible with the need to phase out fossil fuels in line with the Paris Agreement. Insurance companies should not underwrite or invest in some of the most polluting and climate-destroying projects on the planet.”

Extracting and processing tar sands in Canada’s Alberta province, which controls more than 70% of global reserves, on average creates 2.2 times more carbon emissions per barrel than other North American crude oil. The Canadian government projects that tar sands extraction in the province will grow by 77% by 2040. New tar sands mines and the associated pipelines also ravage boreal forests and watercourses, and violate Indigenous rights.

Entitled, Heads in the sand? The insurance industry, tar sands and pipelines, the briefing paper finds that under current market conditions, the proposed expansion of tar sands extraction depends on the construction of new pipelines to refineries and ports. The proposed Trans Mountain Pipeline Expansion project in Western Canada for example would transport 590,000 barrels of tar sands per day, unlocking an estimated 130 million tons of CO2 emissions per year for decades to come, violating Indigenous rights and creating massive threats to ecosystems and public health.

The briefing paper, co-published by Greenpeace US and Rainforest Action Network, names 25 insurance companies which Kinder Morgan, the developer of the Trans Mountain Pipeline Expansion project, has disclosed it has done business with in the past.

"Insurance companies should not insure projects which violate Indigenous rights to free, prior informed consent and undermine the Paris climate agreement. They should stay out of the Trans Mountain Pipeline Expansion project, which Indigenous claimants and their allies have challenged in the courts through 19 separate legal proceedings.”

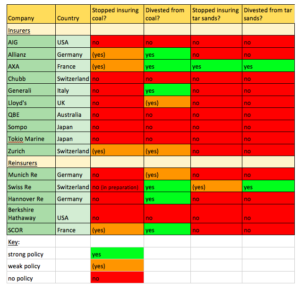

In recent years, at least 17 major insurers have divested an estimated $23 billion from coal companies and five large insurers – including industry giants AXA and Allianz – have stopped insuring new coal projects or are about to do so citing concerns about climate change.

So far only AXA has stopped insuring tar sands and the associated pipeline projects and divested Euro 700 million from the respective companies, while Swiss Re has stopped insuring new (but not existing) tar sands projects. Major insurance companies which continue to insure coal and tar sands include Munich Re, AIG, Generali and Lloyds.

In letter to the CEOs of 25 leading global energy insurers, 12 international NGOs backing the Insure Our Future campaign welcome the growing shift away from coal, but call on the industry leaders to:

- Immediately start divesting from coal, tar sands and the associated pipeline companies;

- Immediately cease insuring coal, tar sands and the associated pipeline projects and companies (unless they are engaged in a rapid transition from coal and tar sands to clean energy that would normally take no longer than two years);

- Stay away from the Trans Mountain Expansion, Keystone XL and Enbridge Line 3 tar sands pipelines in particular;

- Scale up investments in clean energy companies and insurance coverage for clean energy projects that follow international human rights, Indigenous rights, social and environmental standards.

"Climate science and the growing human and economic toll of climate disasters both demonstrate that we cannot afford to build any new coal and tar sands projects. Insurance CEOs need to scale up their ambitions to meet the goals of the Paris Agreement and immediately ditch these extreme fossil fuels.”

The CEOs of the 80 largest insurance companies are meeting in Paris from May 30th to June 2nd for the annual meeting of the Geneva Association, an insurance industry think-tank. The Association Board rejected a request from the Insure Our Future campaign to meet the NGOs to discuss their concerns.

Ahead of the meeting, the Paris city council called on the world’s biggest insurers to end support for the coal industry, citing its impact on climate change and the pollution that causes nearly 23,000 premature deaths across Europe every year.