The following letter was submitted by five environmental NGOs to 50 financial institutions that are major shareholders of MS&AD Insurance Group Holdings. The full version including tables and appendices are available below.

January 18, 2023

Dear Shareholders of MS&AD Insurance Group Holdings,

A Request to Engage with MS&AD

to Stop Underwriting Fossil Fuel Projects

Japan Center for a Sustainable Environment and Society (JACSES)

Kiko Network

Friends of the Earth Japan

Mekong Watch

Insure Our Future

As environmental NGOs, we have urged domestic and overseas financial institutions to stop supporting new fossil fuels projects, in order to align with long-term goals of the Paris Agreement. This time, we send this request letter to 50 financial institutions which are major shareholders of MS&AD Insurance Group Holdings (hereinafter referred to as MS&AD), to ask you to engage with MS&AD to withdraw from underwriting and investing in fossil fuel projects, as MS&AD lags behind domestic and overseas insurers in terms of policies on underwritings and investments in fossil fuel projects.

In November 2022, MS&AD announced that it plans to reduce 6,300 employees by the end of March 2026. According to media reports, the reason behind the personnel cut is to reduce costs in order to improve profitability, as frequent and intensified natural disasters due to climate change has induced insurance payments to soar. While it has been reported that insurance payments for natural disasters that have occurred frequently in recent years are the major crisis in the non-life insurance industry, MS&AD has supported fossil fuel projects, which accelerate climate change, through a huge amount of underwritings and investments, and policies on its underwriting and investment are also extremely weak and not consistent with the long-term goals of the Paris Agreement.

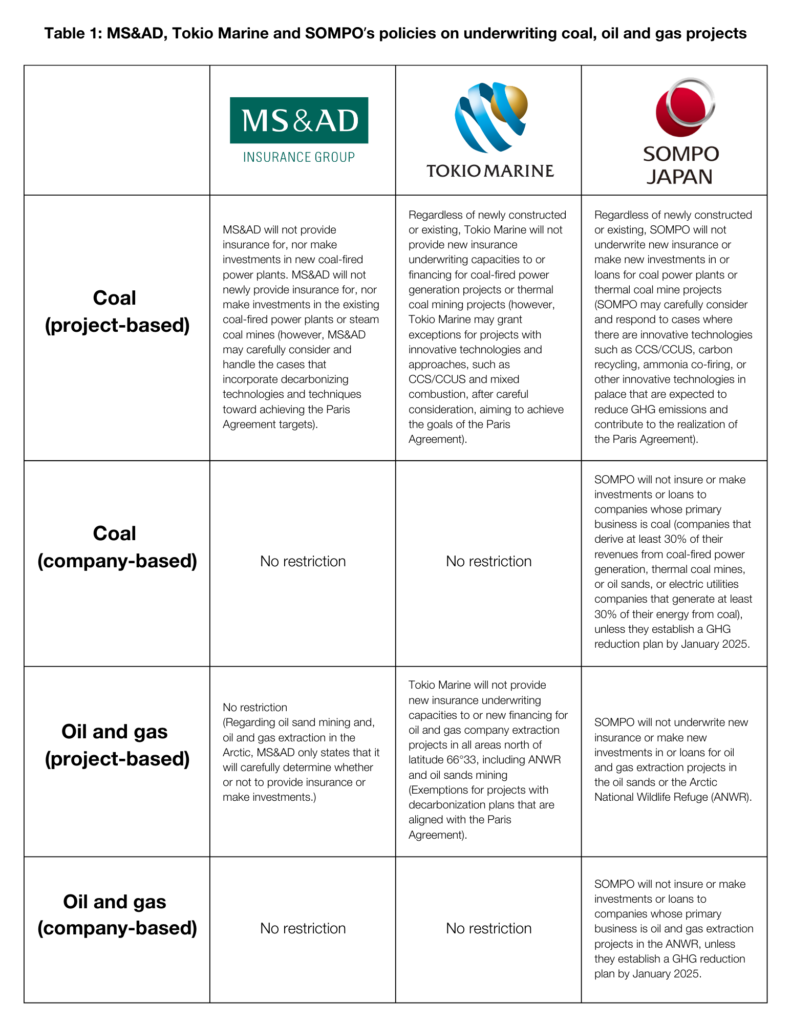

In October 2022, Insure Our Future, an international network of environmental NGOs, published the 2022 version of the scorecard, ranking world’s 30 major insurance companies on their underwriting, divestment and climate actions for coal, oil and gas (*1). According to the scorecard, MS&AD ranked 18th out of 30, the lowest among the Japanese three major insurers (the other two are Tokio Marine and SOMPO).

MS&AD lags behind other insurance companies in the following respects.

1. There is no policy to restrict underwriting and investing in oil and gas projects.

Globally, 13 insurers, including Allianz and Swiss Re, have already set restrictions on underwritings for oil and gas projects. Due to the increasing risks in underwriting and investing in oil and gas projects, in recent years there has been a growing number of insurers globally to stop new business transactions on oil and gas projects. As for Japanese two competitors, in May 2022, SOMPO Holdings (hereinafter referred to as SOMPO) became the first Japanese financial institution that has announced to stop underwriting and investing in oil sands and energy extraction projects in Arctic National Wildlife Refuge (ANWR) (*2), and in September 2022, Tokio Marine Holdings (hereinafter referred to as Tokio Marine) announced to prohibit new business transactions on oil sands minings, as well as Arctic oil and gas extractions in all areas north of latitude 66°33, including the ANWR (*3).

However, MS&AD has not set any restriction on its underwritings and investments in oil and gas projects. It was revealed that MS&AD was one of the international insurers who insured the construction phase of the Ichthys LNG projects between 2012 and 2017, which is reported to be the most carbon-intensive LNG project in Australia. MS&AD has also failed to rule out the possibility of insuring Ichthys’s expansion project currently planned (*4).

According to the report “Net Zero by 2050, A Roadmap for Global Energy Sector” released by International Energy Agency (IEA) on May 18, 2021, no new fossil fuel extraction projects should be approved and the power generation sector needs to reach net zero greenhouse gas emissions globally by 2040 (*5). To reach net zero by 2050, insurers should not be underwriting or investing in new fossil fuel projects, including oil and gas projects, as well as coal projects.

2. There is no policy to stop underwriting and investing in companies highly dependent on coal projects.

In June 2022, SOMPO announced that it will not insure or invest in “companies whose primary business is coal (*6)”, unless they establish a greenhouse gas reduction plan by January 2025 (*7). Although there are still challenges in the policy, in terms of threshold settings (*8) and lack of specific requirements in companies’ GHG emission reduction plans, SOMPO became the first Japanese financial institution to announce the company-based restriction on its underwritings and investments. However, MS&AD have not set any policies to restrict its underwriting and investments on a company basis. Globally, 7 insurers, such as Allianz, AXIS Capital and Zurich, have set company-based restrictions on coal.

3. There is no policy to phase out existing underwritings for coal projects.

According to the report released by Insure Our Future and Solutions for Our Climate (SFOC), an environmental NGO in Korea, it was revealed that MS&AD provided approximately $1,216 million of insurance coverage for the construction of Vung Ang 2 coal-fired power plant in Vietnam, and is the largest insurer of the project (*9). Just before the start of the Vung Ang 2 contract in October 2021, MS&AD strengthened its coal policy in June 2021, announcing it “will not provide insurance for, nor make investments in new coal-fired power plants.” MS&AD argued afterwards that the policy did not apply to projects which had been already under negotiation. It became clear that MS&AD had prepared a loophole in the policy. Although it is still not clear whether MS&AD will continue to be an insurer when Vung Ang 2 starts its operation, it does not have any policy to phase out existing insurance coverage for coal projects. The 14 insurers, such as AXA, Swiss Re, Allianz, AXIS Capital and Zurich, have already committed to reduce their exposure to coal projects from their portfolios to zero by 2040 globally.

4. There are loopholes in policy to stop coal and mining projects.

Although MS&AD announced in June 2022 that it will not underwrite or invest in the existing coal-fired power plants or stream coal mines, it sets an exception that “we may carefully consider and handle the cases that incorporate decarbonizing technologies and techniques toward achieving the Paris Agreement targets.” MS&AD leaves a possibility for future underwriting of coal-fired power plants which apply technologies such as ammonia co-firing, even though there have been a rise of criticisms concerning that they have limited emission reduction effects and are highly likely to be inconsistent with the goals of the Paris Agreement (*10).

Moreover, on June 15, 2022, MS&AD announced its new membership in the Net-Zero Insurance Alliance (NZIA), an international initiative aiming to achieve net zero greenhouse gas emissions in underwriting portfolios by 2050, as well as joining Glasgow Financial Alliance for Net Zero (GFANZ). According to updated criteria by Race to Zero Campaign which is UN-lead climate campaign (*11), it requires to phase down and out all unabated fossil fuels to limit the average global temperature rise to 1.5°C, and its members are expected to set an interim target to achieve in the next decade, which covers all greenhouse gas emissions, including all portfolio, financed, facilitated and insured emissions. The updated criteria comes into effect immediately for companies joining GFANZ umbrella alliances from June 15th, 2022, and member companies of GFANZ are encouraged to follow it.

According to the recommendations published in November 2022 by High-Level Expert Group on the Net-Zero Emissions Commitments of Non-State Entities led by United Nations Secretary-General António Guterres (*12), net zero targets and transition plans of all financial institutions must include an immediate end of lending, underwriting and investments in any company planning new coal infrastructure, power plants and mines. Regarding coal phase out policies from financial institutions, it must include a commitment to end all financial and advisory services and phase out exposure to the entire coal value chain no later than 2030 in OECD countries and by 2040 in non-OECD countries.

We are requesting you, as a MS&AD’s major shareholder to engage with MS&AD to establish; 1) a policy to stop underwriting and investing in oil and gas projects, 2) to remove exceptions in coal policy, 3) to stop underwriting and investing in coal-related companies, 4) to set a target to phase out existing coal projects, in order to align its underwriting policy with the goals of the Paris Agreement.

We would appreciate it if you could send us your institution’s policies regarding this request and the result of your engagement to the contact person below by 17th February. If you wish to discuss or exchange opinions on these issues further, we also welcome the opportunity to arrange a follow-up conversation online at your convenience.

Thank you for your consideration and we look forward to receiving your response.

Notes:

*1: https://global.insure-our-future.com/2022-scorecard/

*2: https://www.sompo-hd.com/-/media/hd/en/files/doc/pdf/e_ir/2022/e_20220527.pdf?la=ja-JP

*3: https://www.tokiomarinehd.com/en/release_topics/release/k82ffv000000efol-att/20220930_Climate_Strategy_e.pdf

*4: https://reclaimfinance.org/site/en/2022/10/05/will-major-insurers-rule-out-support-for-ichthys-lngs-expansion/

*5: International Energy Agency (IEA), (2021), Net Zero by 2050, A Roadmap for the Global Energy Sector, p. 20, IEA, Paris,

https://iea.blob.core.windows.net/assets/0716bb9a-6138-4918-8023-cb24caa47794/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf

*6: SOMPO defines companies “whose primary business is coal” as “companies that derive at least 30% of their revenues from coal-fired power generation, thermal coal mines, or oil sands, or electric utilities companies that generate at least 30% of their energy from coal.”

*7: https://www.sompo-hd.com/-/media/hd/en/files/news/2022/e_20220628_1.pdf?la=ja-JP

*8: A German environmental NGO, Urgewald, has tightened the threshold of companies to be listed in Global Coal Exit List (GCEL), a database of companies involved in coal projects, from 30% to 20%, since the 30% threshold only covers about half of companies that are actually expanding coal projects. Please see below for the details. https://www.coalexit.org/methodology

*9: https://global.insure-our-future.com/wp-content/uploads/sites/2/2022/05/IOF-KEPCO-Briefing.pdf

*10: https://www.kikonet.org/info/publication/hydrogen-ammonia-English

*11: https://climatechampions.unfccc.int/criteria-consultation-3-0/

*12: https://www.un.org/sites/un2.un.org/files/high-level_expert_group_n7b.pdf